Securing Your Assets: Hypothecation Legal Experts

Protecting your assets has become more important than ever in today’s fast-moving financial world. Whether you are an individual, a business owner, or a growing startup, you may often depend on loans or credit facilities to support your financial goals. However, when you borrow money, lenders usually require some form of security. One of the most common forms of security is hypothecation. Even though it is widely used, many people still do not fully understand what it means or how it works. That is exactly where hypothecation legal experts play a crucial role.

At Virtuoso Legal Services – Expert Legal Solutions 24×7, we guide clients through the entire process of hypothecation with clarity, confidence, and continuous support. In this article, you will learn what hypothecation is, why legal guidance matters, how disputes can be resolved, and how our firm helps individuals and businesses protect their assets smarter and safer.

Securing Your Assets: Hypothecation Legal Experts – Virtuoso Legal Services

Understanding Hypothecation: A Simple Explanation

To put it simply, hypothecation means offering an asset as security for a loan without giving up possession of that asset. For example, when you take a vehicle loan, the car remains with you, but the lender has a legal right over it until you repay the loan.

Similarly, businesses often hypothecate machinery, stock, equipment, or raw materials to raise funds. While this arrangement is flexible, it also creates duties, risks, and legal responsibilities that must be handled with care.

Hypothecation does not transfer ownership. Instead, it creates a charge in favour of the lender. Because of this, the arrangement needs to be documented properly, with accurate terms, clear conditions, and transparent rights for both parties.

Why Hypothecation Needs Legal Expertise

Although hypothecation may look simple on the surface, it involves a number of legal complexities. A single mistake in documentation can lead to disputes, financial losses, or even legal action from lenders. This is why clients constantly turn to experts like Virtuoso Legal Services – Expert Legal Solutions 24×7.

Here are some common areas where legal guidance becomes essential:

1. Drafting Hypothecation Agreements

A well-drafted agreement safeguards the borrower and sets clear expectations for the lender. It includes:

- Nature of the charged asset

- Borrower’s responsibilities

- Events of default

- Lender’s rights in case of non-payment

- Insurance and maintenance requirements

We ensure that every document is detailed and easy to understand.

2. Reviewing Loan Terms

Many clients sign loan documents without reading the fine print. Our legal team carefully reviews all terms and conditions, clarifies risks, and negotiates fair rights for borrowers and lenders.

3. Registration and Compliance

Hypothecation charges, especially for businesses, need to be registered with ROC or concerned authorities. Missing deadlines or filing incorrect details can cause legal trouble. We manage the entire compliance process smoothly.

4. Protection Against Misuse

Sometimes lenders misuse hypothecation rights by taking possession unlawfully or charging hidden fees. Strong legal support helps prevent such exploitation.

5. Dispute Resolution

If disputes arise, timely legal intervention protects your financial interests. We take care of:

- Unlawful repossession

- Wrongful invocation of security

- Miscalculation of dues

- Violation of contract terms

- Breach of trust

Our goal is always to secure your assets and your peace of mind.

How Hypothecation Helps Individuals and Businesses

Despite its complexities, hypothecation remains one of the most convenient ways to obtain credit. It offers several benefits:

• You Keep and Use Your Asset

Unlike mortgages, where you may lose possession, hypothecation lets you use the asset while still offering it as security.

• It Allows Quick Access to Funding

Banks easily accept movable assets like vehicles, stock, or equipment, allowing faster loan approvals.

• Ideal for Business Growth

Businesses can raise working capital by hypothecating inventory, receivables, or machinery, keeping operations smooth.

• Flexible and Affordable

Hypothecation loans usually carry better interest rates than unsecured loans, making them a smart financial tool.

However, these benefits come with responsibilities. You must maintain the asset, avoid selling it without consent, and regularly update lenders about changes. Our legal experts help you stay compliant while enjoying the advantages of hypothecation.

Common Legal Risks in Hypothecation

Even though hypothecation is widely used, it brings certain risks that clients often overlook. Understanding these risks helps you make better decisions and avoid future disputes.

1. Multiple Charges on the Same Asset

Some borrowers unknowingly or intentionally create multiple charges on one asset. This leads to serious legal issues and loan recovery actions.

2. Inaccurate Disclosure of Asset Details

If the value or condition of the asset is misrepresented, lenders can take legal action for fraud or breach of contract.

3. Unauthorized Sale of Hypothecated Assets

Selling or transferring hypothecated property without permission is unlawful and can invite criminal liability.

4. Hidden Clauses in Agreements

Many agreements include clauses that allow lenders to take harsh actions. Legal review is essential to avoid surprises.

5. Sudden Invocation of Security

In the event of default, lenders may seize or sell the asset. Proper legal support helps challenge unlawful or unfair actions.

At Virtuoso Legal Services, we guide you through each of these risks and provide the right legal strategies to protect your rights.

How Virtuoso Legal Services Supports You

Our firm, Virtuoso Legal Services – Expert Legal Solutions 24×7, is committed to delivering reliable, practical, and result-oriented legal assistance. Not only do we help with documentation and compliance, but we also stand with you during disputes or negotiations.

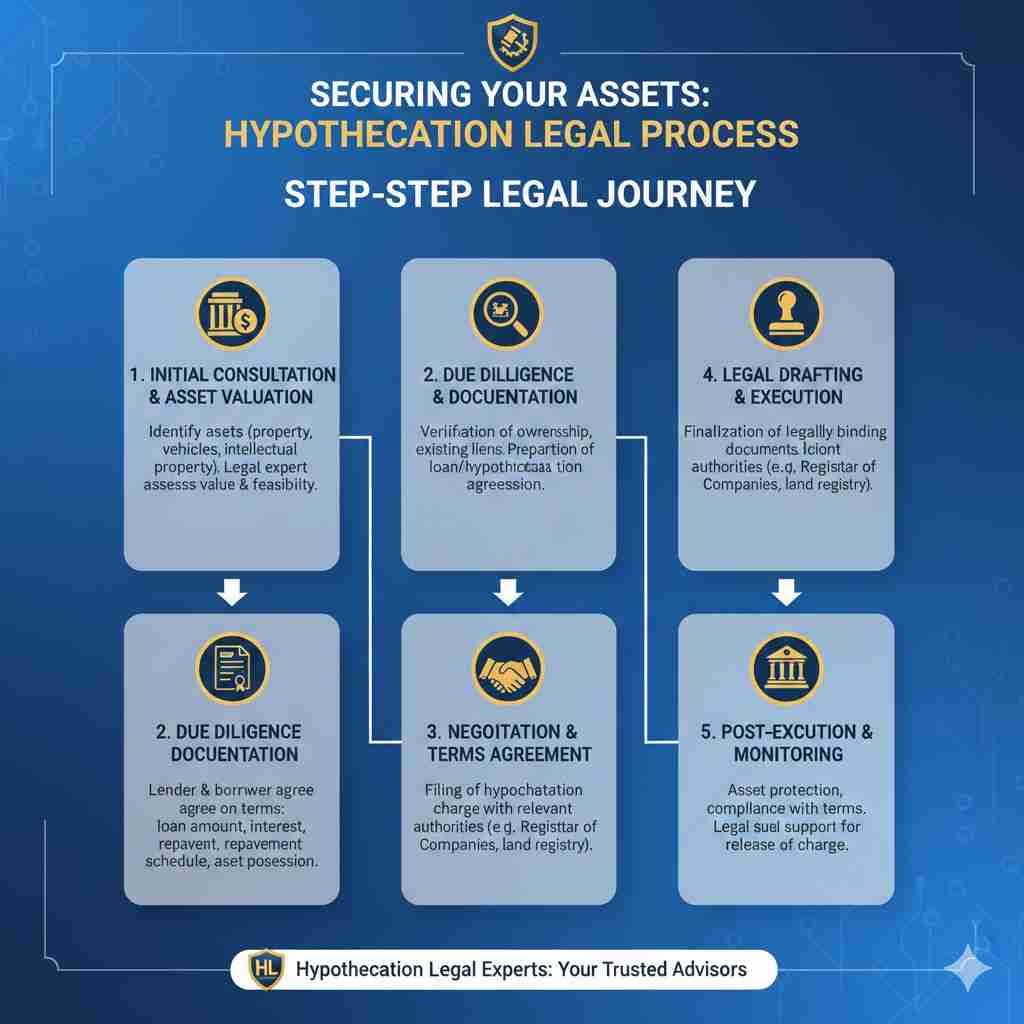

Here’s how we support your legal journey:

1. End-to-End Documentation

We prepare, review, and finalize hypothecation agreements that match your financial goals and ensure fairness.

2. 24×7 Legal Guidance

With our round-the-clock service model, you receive legal support whenever you need it—day or night.

3. Expert Negotiations

We communicate with banks and financial institutions to ensure smooth and transparent negotiations.

4. Legal Protection During Disputes

Our litigation team protects your interests in courts, tribunals, or arbitration proceedings.

5. Asset Protection Strategy

We advise borrowers and businesses on the safest way to secure assets, avoid risks, and stay compliant.

We combine legal knowledge with practical experience, making your hypothecation process stress-free.

When Should You Consult a Hypothecation Lawyer?

Many people approach lawyers only when a dispute arises. However, it is always wise to seek legal support early. You should consider consulting a hypothecation legal expert when:

- You are planning to take a loan using movable property

- You need help understanding the agreement

- The lender is pressuring you with unfair terms

- You plan to modify, sell, or replace the hypothecated asset

- You have received a default notice or repossession threat

- You suspect unlawful actions by a bank or lender

Acting early saves time, money, and stress.

Why Choose Virtuoso Legal Services?

Clients trust us because we offer:

✔ Simple Explanations

We break down complex legal terms into everyday language.

✔ Practical Solutions

Our advice focuses on real-world results, not just theory.

✔ Transparent Process

You always know what is happening and why.

✔ Experienced Team

Our lawyers have deep expertise in banking, finance, and asset protection.

✔ 24×7 Support

We stand with you every minute, offering continuous legal assistance.

When your assets are at stake, choosing the right legal team makes all the difference.

Frequently Asked Questions

Hypothecation is a legal arrangement where a borrower offers movable assets, such as vehicles, machinery, or inventory, as security for a loan without giving up possession. This helps borrowers access funds while still using the asset. Lenders gain confidence because they have a legal charge over the asset until the loan is fully repaid.

A hypothecation expert helps you understand loan terms, draft or review agreements, and ensure compliance with legal requirements. Since hypothecation involves rights and obligations for both parties, any mistake can lead to disputes or heavy financial losses. An expert protects your interests and ensures a fair and legally sound arrangement.

Common issues include unclear contract terms, wrongful repossession, creation of multiple charges on the same asset, non-disclosure of asset condition, and disputes over repayment or default. These problems can escalate quickly, so having legal support helps prevent or resolve conflicts effectively.

Yes, lenders can take possession or initiate recovery if you fail to repay the loan. However, the process must follow proper legal procedures. If a lender acts unfairly or violates the agreement, a hypothecation legal expert can challenge the action and protect your rights.

Virtuoso Legal Services provides 24×7 assistance in drafting agreements, reviewing loan terms, ensuring compliance, and handling disputes. The firm safeguards your assets by offering clear guidance, strong legal representation, and practical solutions throughout the entire hypothecation process.

Conclusion: Secure Your Future with Expert Legal Guidance

Hypothecation is a powerful financial tool that helps individuals and businesses grow. However, because it involves legal rights, duties, and risks, it must be handled with careful attention. With proper guidance, you can enjoy the benefits of credit while keeping your assets safe.

Virtuoso Legal Services – Expert Legal Solutions 24×7 is committed to helping you navigate every step of the hypothecation process with confidence. Whether you need documentation, compliance support, dispute resolution, or strategic legal advice, our team is always ready to assist you.

Read More

- Fighting Against Violations: Human Rights Violation Legal Opinion Services

- Championing Human Rights: Human Rights Law Specialists

- Advocating for Government Service Rights: Government Service Matters Legal Experts

- Franchise Agreements Made Simple: Legal Opinion Services

- Ensuring Fair Foreign Exchange: Foreign Exchange Law Experts

- Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI)

![Virtuoso Legal Services [Best Legal Opinion Services 24×7]](https://legalopinion.org.in/wp-content/uploads/2023/09/cropped-logo.png)